The Best Guide To Succentrix Business Advisors

The Best Guide To Succentrix Business Advisors

Blog Article

All about Succentrix Business Advisors

Table of ContentsThe Greatest Guide To Succentrix Business AdvisorsAll about Succentrix Business AdvisorsAll About Succentrix Business AdvisorsThe Facts About Succentrix Business Advisors UncoveredWhat Does Succentrix Business Advisors Do?

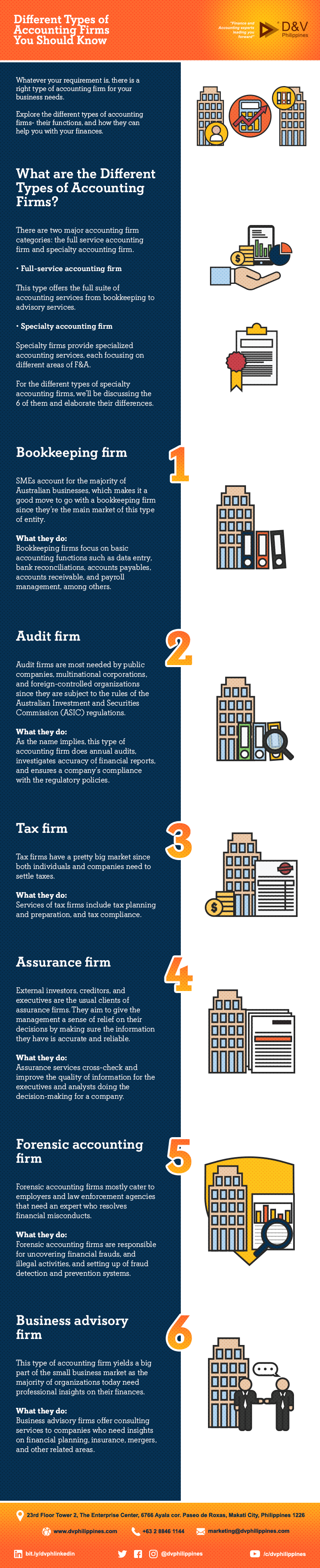

Getty Images/ sturti Outsourcing audit services can release up your time, stop mistakes and also minimize your tax obligation bill. Or, maybe you want to handle your general accounting tasks, like accounts receivables, however hire a consultant for cash circulation forecasting.Discover the different kinds of accountancy solutions readily available and learn exactly how to select the right one for your little organization demands. Bookkeeping services fall under general or economic accounting. General accountancy refers to routine duties, such as taping transactions, whereas monetary accountancy prepare for future growth. You can hire a bookkeeper to get in information and run reports or collaborate with a certified public accountant who supplies economic advice.

Prepare and file tax returns, make quarterly tax settlements, data expansions and manage Internal revenue service audits. Create financial statements, including the balance sheet, earnings and loss (P&L), cash money circulation, and revenue declarations.

Succentrix Business Advisors - Questions

Track job hours, determine earnings, hold back tax obligations, problem checks to workers and make certain accuracy. Bookkeeping solutions might also consist of making pay-roll tax obligation settlements. In addition, you can employ professionals to create and establish your bookkeeping system, supply financial preparation recommendations and describe financial declarations. You can outsource primary monetary police officer (CFO) services, such as succession planning and oversight of mergers and purchases.

Often, little organization owners contract out tax services first and add pay-roll help as their business expands. According to the National Local Business Organization (NSBA) Small Organization Tax Survey, 68% of participants utilize an exterior tax specialist or accountant to prepare their company's taxes. On the other hand, the NSBA's Innovation and Business Study found that 55% of local business owners take care of payroll online, and 88% manage financial accounts electronically.

Create a list of procedures and duties, and highlight those that you want to contract out. Next off, it's time to find the best accountancy provider (Professional Accounting and Tax services). Since you have an idea of what sort of audit services you require, the question is, who should you employ to provide them? While an accountant takes care of information entry, a CPA can speak on your behalf to the Internal revenue service and provide monetary advice.

The Succentrix Business Advisors Ideas

Before choosing, take into consideration these questions: Do you want a neighborhood bookkeeping expert, or are you comfortable working practically? Does your company call for market expertise to carry out audit jobs? Should your outsourced services incorporate with existing bookkeeping tools? Do you want to outsource personnels (HR) and pay-roll to the very same vendor? Are you seeking year-round assistance or end-of-year tax obligation management solutions? Can a specialist complete the work, or do you need a group of professionals? Do you require a mobile application or on-line portal to manage your accounting services? CO intends to bring you inspiration from leading reputable professionals.

Brought to you by Let's Make Tea Breaks Happen! Obtain a Pure Fallen Leave Tea Break Give The Pure Leaf Tea Break Grants Program for tiny services and 501( c)( 3) nonprofits is currently open! Get a possibility to fund ideas that cultivate healthier workplace culture and norms! Concepts can be new or currently underway, can come from HR, C-level, or the my website frontline- as long as they boost employee health with society adjustment.

Something went incorrect. Wait a moment and try once more Attempt again.

Maintaining up with ever-evolving accountancy standards and regulatory requirements is critical for businesses. Audit Advisory specialists assist in economic reporting, making certain exact and certified monetary declarations.

The 4-Minute Rule for Succentrix Business Advisors

Right here's a detailed consider these crucial abilities: Analytical skills is a vital ability of Audit Advisory Providers. You ought to excel in celebration and examining financial information, attracting significant insights, and making data-driven suggestions. These abilities will certainly allow you to assess financial efficiency, determine patterns, and offer educated guidance to your clients.

Communicating successfully to clients is an essential ability every accountant ought to have. You need to have the ability to share intricate monetary info and insights to customers and stakeholders in a clear, understandable fashion. This consists of the ability to equate economic jargon right into simple language, create thorough reports, and supply impactful presentations.

Facts About Succentrix Business Advisors Uncovered

Bookkeeping Advisory firms use modeling strategies to simulate different financial circumstances, examine possible outcomes, and support decision-making. Efficiency in financial modeling is essential for precise forecasting and strategic preparation. As an audit advising company you have to be skilled in financial guidelines, accountancy requirements, and tax laws appropriate to your customers' industries.

Report this page